From the desk of Don Stuart, Preserve Our Nation, LLC

10/15/2010

Pass this pamphlet to your friends!

Donate to Our Cause

Part 3

Inflation and Unemployment

What is inflation? How is inflation controlled? And by whom?

The four measurements of the economic Gross Domestic Product (GDP), sometimes referred to as the four corners of GDP, are Unemployment, Low Inflation, Positive Trade Balance and Sustained Economic Growth. We now look at how Unemployment, Productivity and Investment affect Inflation.

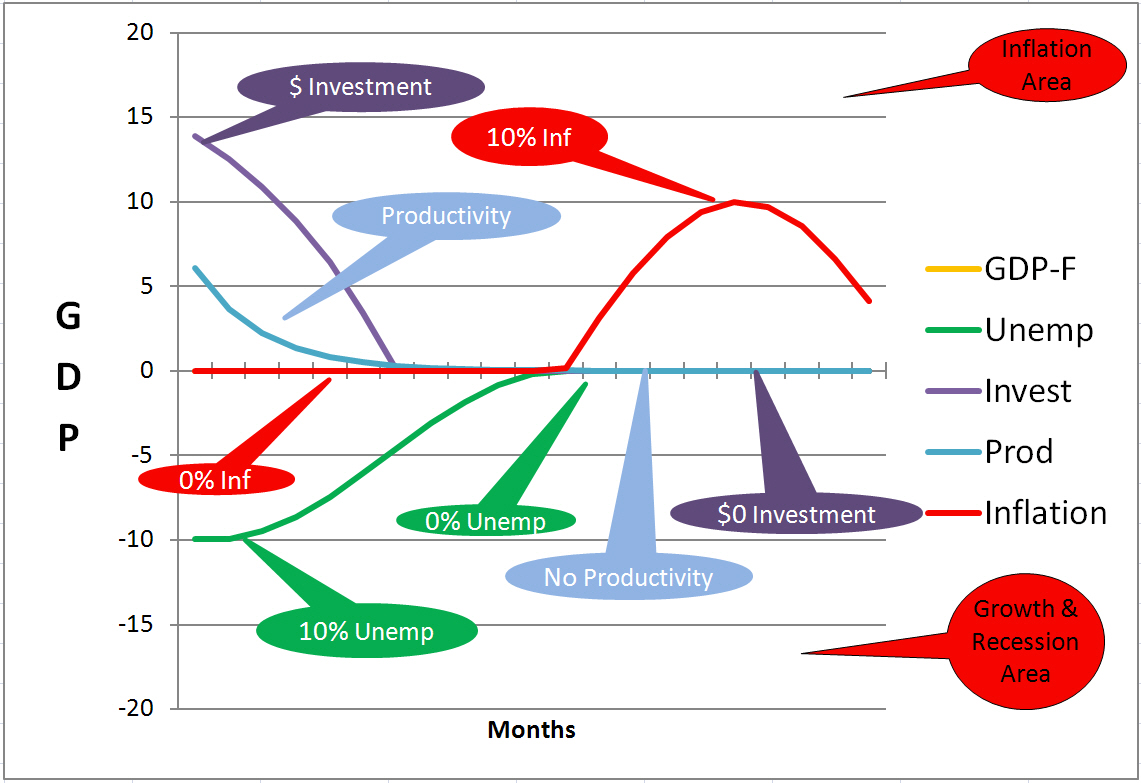

To understand these measurements, inflation is best analyzed using the Potential GDP chart as shown below. This is a typical chart where Potential GDP is on the vertical axis and time (months) is on the horizontal axis. The curves represent Unemployment, Investment, Productivity and Inflation. Potential GDP has been placed on the Zero GDP value to illustrate relationships and not a particular Potential GDP.

Potential GDP

The Potential GDP (often referred to as Full Resources Employed GDP and denoted as GDP-F) is the maximum GDP where all resources have been utilized. This utilization represents full employment of the labor supply, full investment of capital and maximized advanced technology for productivity increases.

Employment

Full employment means that there is no more available labor to be hired. Usually this is denoted by 0% Unemployment. But it could mean that those unemployed are not looking for jobs or refuse to work in these jobs. A 4-5% Unemployment is considered acceptable as full employment and is considered a good economic indicator. Inflation can occur with a low percentage of unemployment.

Productivity

Maximized productivity means that no increase in productivity can be achieved. In other words, all technical advances have been exhausted. The facilities including equipment, materials, and computers have been maximized to the point that no additions can be added to increase productivity.

Investment

Capital investments dry up due to a lack of potential profit from building more facilities or purchasing equipment and tools. A lack of labor and lack of potential productivity improvements decreases the availability of investments.

In the chart below, the Potential GDP line represents the "sweet spot" where Inflation can begin: Full Employment (0% Unemployment), minimum Productivity, and minimum Investment.

How are the Unemployment, Investment and Productivity related to Inflation? The Potential GDP chart below answers this question and many others.

GDP Inflation - Unemployment Curves

The bottom half of the chart represents the "Growth and Recession Area" and was discussed in Part 1 and Part 2 of this series of pamphlets. (If you missed them, access them now for review: Part 1 or Part 2.)

The top half of the chart represents the "Inflation Area" which is above the Potential GDP. Note in this chart, the Potential GDP is neutralized to zero and does not represent any particular GDP value.

Inflation

Now let's turn our attention to Inflation.

Inflation is the rise in prices. But all price increases are not inflationary. Inflation occurs when the demand for a product cannot be met by the current supply and the supply cannot be increased. As stated above when more employees cannot be hired, productivity gains are not available, nor are investments available to build more facilities or purchase equipment. Inflation will occur as prices rise due to the increased demand and limited supply.

As can be seen on the left side of the chart, productivity is falling. At the same time investments are drying up and are not available. These two curves merge toward zero forcing the hiring of more employees to the meet the consumer demands.

On the chart, unemployment is moving from -10 to 0% as businesses hire all the available manpower. When full employment is finally reached, the result can only be the increase in prices as the consumer demand continues.

As long as there is available labor, available productivity gains and available investment money, the Potential GDP can rise resulting in economic growth. As the economy grows, the economic pie of America becomes larger and larger, employing more people who are reaping the rewards.

How can Potential GDP increase without incurring inflation? Answer: Increase the labor supply, provide capital investment and increase productivity.

Achieving all three of these depend on the Government, University Research and Private Industry (Corporations and Small Businesses). Immigration can shore up the labor supply. The Federal Reserve keeping interest rates low can make money available for investments. Government and private money can fund university and private research to create the technology to improve productivity.

A bright future for corporations and small businesses also must exist. The Government must insure a stable playing field in which businesses can operate. Businesses must know the rules and regulations under which to operate; and, these rules and regulations, including taxes, must be defined. In other words, no new unexpected rules and regulations should exist down the road as in tax increases and mandates putting hardships on the business. Let corporations and small businesses succeed or fail on their own: Keep Government out of the picture.

Due to the current economic downturn (recession), economists predict that the US economy will grow at a miserly 2% for the next decade. Obtaining a growth rate of 3-4% of GDP will not grow us out of debt. It may take 10 years to achieve the 3-4% growth rate by following the same old strategies, followed by 20-30 years required to double our GDP. That is a 30-40 year wait we cannot afford. Our children and grand children cannot afford for us to wait.

One of our goals is to have an annual 7-8% rise in the GDP over the next 10 years. Accomplishing this would double the GDP to 28 Trillion dollars. But this must be accomplished with minimum inflation by increasing Potential GDP.

To double GDP in 10 years requires the following:

| Goals |

|

We have to achieve a 7-8% growth rate as soon as possible and maintain it for an extended period of time. Once achieving 7%, we can double our GDP in 10 years. Doubling the GDP will reduce by half our projected debt/GDP ratio from 60% to 30%, balance budgets and provide excess revenue to pay off part of the debt each year.

Utilizing my projections of 7-8% growth rate, it would be likely that we could balance the budget in 4-6 years (assuming no more spending increases above 2008 level) and eliminate our accumulated debt in the following 15 years. That could be accomplished in 20 years enabling us to eliminate our national debt.

Results of doubling the GDP in 10 years

| Results |

|

Achieving this goal would not eliminate the passing of the debt to our children, but at least the debt transfer would end there!

Learn what you can do to help save our Nation! Visit our Website Home Page!

| DONATE TODAY! |

|