A Pamphlet from Don Stuart, Preserve Our Nation, LLC

Pamphlet #46 - 09/8/2023

Pass this pamphlet to your friends!

Donate to Our Cause

Join Our Email List!

Bidenomics and Process Control

What is "Bidenomics?"

Bidenomics involves "using the tax system to promote not just economic growth, but to incentivize certain social outcomes as well" per Tax Notes White House reporter Alexander Rifaat (Reference Tax Notes Podcast). Continuing "the IRS was not just a tax collection agency, but also a crucial benefits provider as well" and following "if you can modernize the IRS, you can expand and strengthen its capabilities to distribute social benefits."

The Liberal concept is for the IRS to be the government distribution of Social Benefits. Just collecting taxes is not enough!

Moving on to Process Control. I have been designing manufacturing Process Control Systems for more than 48 years. The main concept in Process Control is Cause (Actions) and Effects, that is when some action is taken what is the effect your are trying to achieve. In Process Control, we perform an action (cause) to see what will happen as a result (effect). Once we know the answer, we then can program the manufacturing process (computers). As I said, I've been doing this for 48 years.

Cause and Effects is a universal control procedure, that is this is now the Universe is controlled. The Apple falling from the tree was the Effect. Gravity was the Cause. So everything in our daily life is a response to Cause and Effect. Even driving a car: Turn the steering wheel to the left, the wheels turn to the left and the front of car pulls to the left. As you go throught the turn and you approach your desired direction, you gradually turn the steering wheel back straight. The car heads in a forward direction. Cause and Effect!

A simple example of Cause and Effect illustrates this: when you turn the gas on under a pot of water, you expect to pot to heat and transfer heat to the water to bring to a boil. If you don't see the water boiling, you add more gas. The question is "when do you add more gas?" The Answer is after you have given the heat transfer time (Lag) to occur. Thus, the action has a lagging time delay before the effect happens. Once it starts boiling, you can cut the gas off and the effect is for the boiling to stop after a short time delay. As you can remember, it takes longer to bring the water to a boil than it does to stop the boiling.

The economy is the same. When reducing tax rates, it takes longer for the tax rate reduction to effect, that is, to see the increased personal and business tax revenues. This is due to the tax reduction taken time to filter down to the individuals and businesses (Tax returns) before they can spend the money on consumption.

But raising tax rates can affect the decline in personal and business tax revenues quickly. When individuals and businesses realize their taxes are going up, they start saving (Spending Less). The GDP (Gross Domestic Product) responds the same way. Implementing policies that effect the increase of GDP can take a long (Lag) time delay. Whereas implementing policies or eliminating previous policies can affect the decline of GDP growth rate quickly.

In summary, it is easier and quicker to remove/reverse policies that increase the GDP. Policies that decrease the GDP are tax increases (personal and business), business rules and regulations, Environmental rules and other deep State regulations.

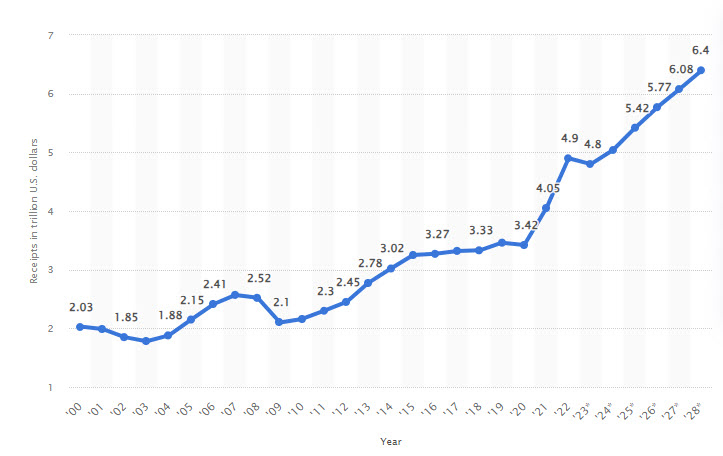

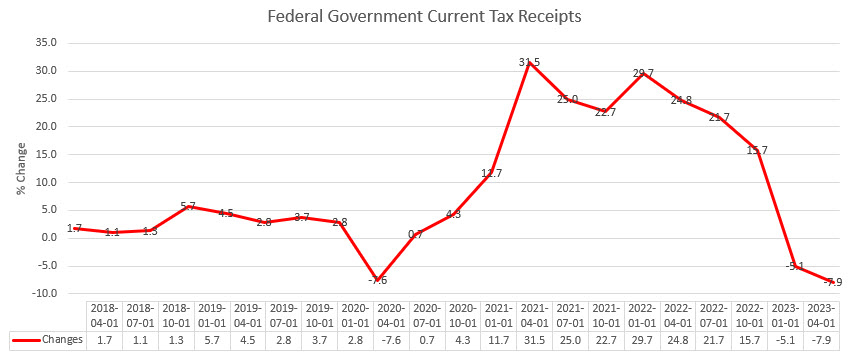

It took President Trump two (2) years in office to get the Tax Reductions implemented. Some minor effects in tax increases came quickly but the major tax increases took several years to achieve via lagging time delay. Thus, showing up as $1 Trillion increase in tax receipts from $3.9 Trillion in 2018 to $4.9 Trillion in 2022. Per the second quarter of 2023, tax receipt's growth rates are now down that is a -7.9% decline. Tax receipt's growth rate has been falling since the end of first quarter of 2021 when Biden took office. (See FRED Federal Reserve Growth Chart farther down.)

Total Governement Receipts. Note the projections (2024-2028) are based on the 2018 Trump Tax Reductions are renewed in 2025.

Source: Statista

|

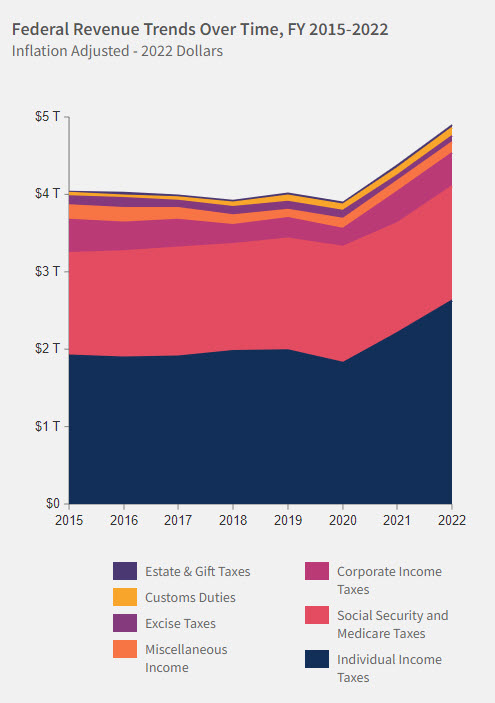

Tax Revenue 2015 - 2022

Source: Treasury.gov

|

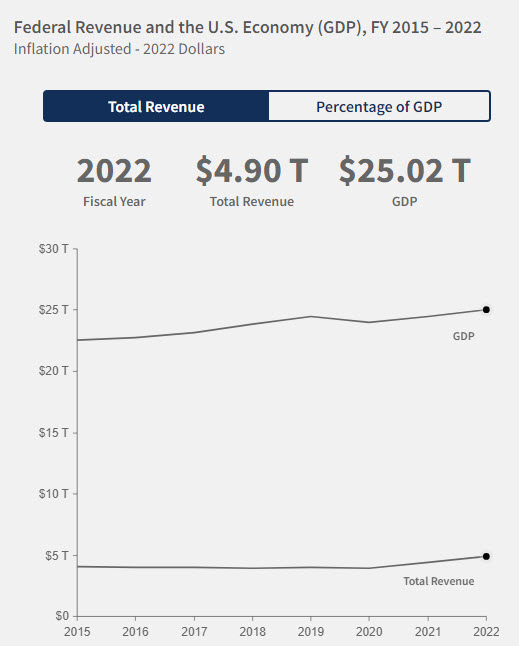

GDP 2015 - 2022

Source: Treasury.gov

|

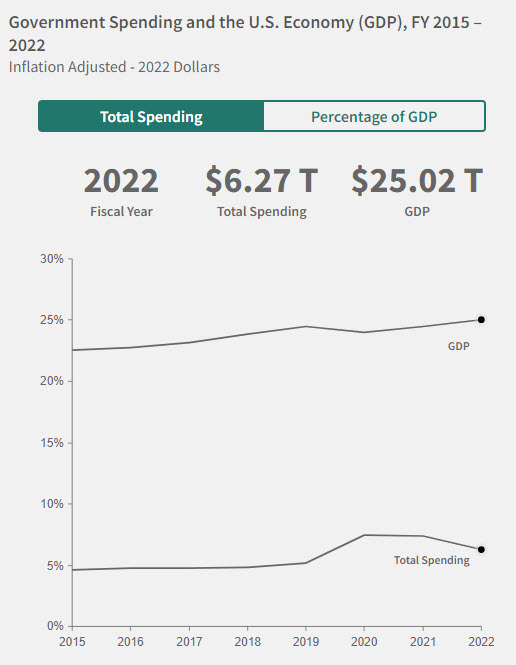

GDP 2015 - 2022

Note that the vertical axis is in Trillions (T) not Percent as showm. See above Revenue Chart.

Source: Treasury.gov

|

As you can see, 2022 Spending of $6.27 Trillion, exceded Revenues of $4.9 Trillion.

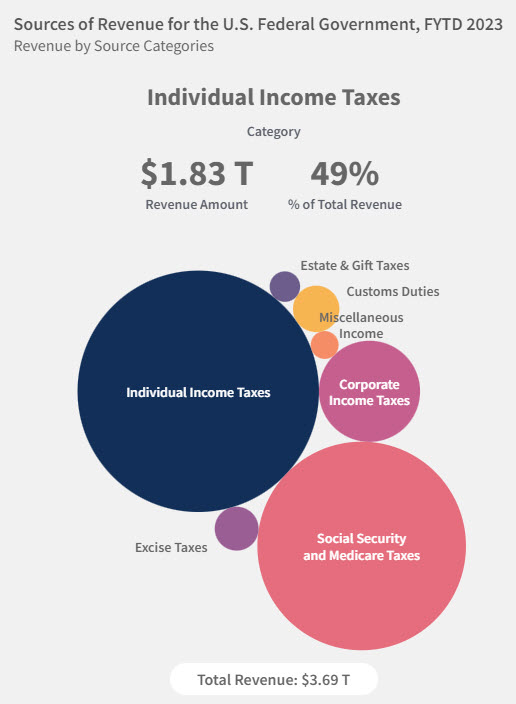

In another direction, just for conversation, in 1913 the 16th Amendment was passed to tax INCOME. Originally this was ment to tax GAINS on Businesses but as you can see Personal Income pays more taxes than businesses. Individual taxes are 39% and Business taxes are just 9% of total revenue.

We are in the final Fiscal quarter of the 2023 year with $3.69T Revenue and $5.3T Spending (for a 2023 deficit so far of $1.6T) and we may see a recession this quarter. Thus the revenues may not return to last years gross receipts of $4.9T. Per the above chart from STATISTA for 2023 tax receipts was projected to be $4.8T. Most likley tax receipts will not reach that target.

Federal Revenue Year to Date 2023

We are Three Quarters through the Fiscal Year.

Source: Treasury.gov

|

Quarterly Tax Receipts Percent Change Chart since tax reform.

Note that in the chart the date 2021-04-01 is the end of the 1st

calendar quarter January-March of 2021 when the first decline started and 2022-04-01 is the end of the 1st calendar quarter January-March 2022

when the final growth rate decline started.

Source: FRED Frederal Reserve St. Louis

|

The Biden Administration and Liberal Media has been touting Bidenomics for the growth in taxes during the First and Second quarters of 2021 (31.5% and 25.0%) when, in fact, the taxes were increasing since the end of the Second quarter of 2020 (2020-07-01 going from -7.6 to +0.7)and continuing 2022 as shown in the growth rate table above. Biden took office in January 2021. It then only took two quarters for Bidenomics to start the steady decline in the growth rate of tax revenue throughout 2021, 2022 and 2023. Since then, the growth rate in tax revenue has decreased such that it is currently negative as stated above to the tune of -7.9% decline.

It took the effects of tax reduction to take several years to manifest itself, but Bidenomics took only two quarters to totally reverse the direction. This occurred even without Tax increases (one of the effects of declining tax revenue) that Biden wanted. Now some of this decline was caused by COVID. First, by Trump during the first months due to taking cautions as the buildup for getting vacines ready for production. But as the Tax cuts took effect, the tax receipts started climbing. As stated above (1st charts) total tax receipts climbed from 3.9 Trillion in 2018 to 4.9 Trillion in 2022

But then Biden shutdown the economy with everyone told to stay at home during 2021 and 2022. With all the other decisions, the growth rate of tax receipts started declining and continues today, possible resulting in an upcoming recession. But Covid is passed and getting workers back into the work force has been difficult. It is still lagging due to Bidenomics.

We've got sixteen more months of Bidenomics. Recession is looming ahead. Sooner than most think. How much more damage can they do?

Due to the eight years of Obama policies, remember that Obama and Clinton projected that the normal GDP growth for the future would be 1.5%. Looks like Bidenomics is targeting that same 1.5% growth for the future. Hopefully, Bidenomics can get GDP growth rate back up to 1.5% after the coming recessions of negative growth (See Pamphlet #45). Under Bidenomics or Democrat control, never expect the tax revenue growth rate or GDP growth rate to return to the Trump era.

The 2024 election results will be a reflection of the Nation's desires/expectations for the future. If a Conservative wins in 2024 along with holding the House and winning the Senate,

the duration of returning to prosperity via Tax Revenue Growth and GDP Growth will still take a couple of years. On the other hand, if a Liberal wins in 2024 then we can see the

Progressive goal of gobalization under the World Economic Forum (WEF) in the form of IMPERIALISM. Implementing the WEF's Great

Narrative of WORLDWIDE Supreme Socialism, "You'll own nothing and be Happy". That is their PLEDGE!

Remember that Communism owns everything including you. Socialism just controls what you own and earn and THINK.

Victor Davis Hanson has stated that the World Economic Forum "vision is of a transnational ruling class, consisting of elites drawn mostly from business, political, media and academic worlds, with the power to issue edicts on climate change, public health, diversity, human rights, and even taxes, that override the will of national majorities." Hanson further states "That the totalitarian rule they want to impose is for our benefit and the larger brotherhood of man."

"You'll own nothing and be Happy."

There goes our Constitution's promise of "Life, Liberty and Pursuit of Happiness (Prosperity)".

Without GDP growth that generates Tax Revenues, we cannot balance budget much less paydown the National $33 Trillion debt.Getting the economy growing is our only solution to holding on to the Constitution's promise of Life, Liberty and Pursuit of Happiness (Prosperity).

(Note: see Pamphlets #42, #43 and #44 for 2015 Debt analysis of GDP growth of Obama 1.5%, Clinton -2.6% and Clinton proposed 2.0%, Trump 3.0% and 8.2% as varied comparisons. Today the numbers may be different but the prospects/relationships are the same.)

Under Bidenomics, we are losing the fight.

Learn what you can do to help save our Nation! Visit our Website Home Page!

| DONATE TODAY! |

|