A Pamphlet from Don Stuart, Preserve Our Nation, LLC

Pamphlet #39 - 10/20/2013

Pass this pamphlet to your friends!

Donate to Our Cause

Join Our Email List!

Social Security

The Good, The Bad and The Ponzi

|

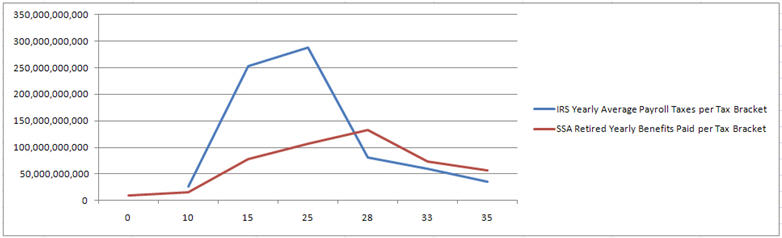

Social Security has its good points and bad points. But in the end, for many, it is a Ponzi scheme. For others it is a plan into which they pay but never receive back a penny. Most will receive more than they pay in. What you receive depends on when you die and how much you paid in FICA taxes. This pamphlet gives an overview of the Social Security System: the Good, the Bad and the Ponzi. This pamphlet is not a substitute for reviewing the Social Security website where the complicated benefits can be found. This pamphlet highlights the Good, the Bad and the Ponzi. Of the three types of benefits, this pamphlet covers retirement benefits but not survivors or disability benefits. And this is just an overview to illustrate important points. Social Security is a government run retirement insurance program, not a savings program, where contributions are forcibly taken by the Government via employers and enforced by the IRS. The money is taken from your paycheck (FICA), matched by your employer and sent to the IRS. Social Security is not a saving program because contributions are used to pay current benefits. Social Security is another progressive program in a line of many, such as Income Tax. In addition, over the years, the Social Security System has been made more progressive by the Democrat Liberals with help from some Republicans. History The Social Security program as introduced by Franklin Roosevelt in 1937 was to be an all voluntary program. The initial tax deductible contribution of 1% of the first $1,400 of annual income has now risen to 6.2% of the first $113,700 which is matched by your employer at 6.2% of $113,700. The original $1,400 adjusted by inflation would be $22,738 in todayís dollars not $113,700. Todayís FICA contribution is a 1,740% increase above the inflation rate not taking into account contributions that are no longer tax deductible. The voluntary part was dropped long ago as well as the tax deductibility. Initially, the contributions (FICA) were deposited into a Trust Fund from which only the Social Security program could withdraw for payments and operating expenses. The Trust was limited as to where the Trust funds could be invested, that is only in government notes/investments at low interest rates. President Johnson allowed the Trust funds to be loaned to the Government and deposited in the Government General Funds which issued IOUs via special ďOn DemandĒ notes to the Trust Fund. These special notes pay a varied interest rate depending on the rate at the time of issue. These transfer to the general fund monthly. The transfer works this way. Each month the Social Security receives FICA payments from individuals and an equal amount from the individualís employer, 6.2% for each. Also during the month payments are made to individuals receiving Social Security payments. Any FICA funds left over after payments are transferred to the General Fund for IOUís. This has been occurring since President Johnson initiated these transfers. Recently the transfer of these funds has reversed direction. The FICA monthly funds available are not enough to cover the monthly Social Security payments. Now some of the IOUs are refunded monthly and the money from the General Fund is moved back to the Trust Fund to cover the shortfall in the monthly Social Security payments. Under President Carter, Social Security enabled immigrants to start receiving payments even if they had not paid a penny in FICA taxes. Initially, the Social Security payments were tax free. But under President Clinton, the tax deductibility of monthly payments has been reduced to 15% of the payments allowing 85% to be taxed. Social Security now represents a Liberalsí progressive dream come true. Or so they think so. As in any government program even the best intentions of the Liberal Progressives have unintended consequences. Intended desires were to provide a retirement income for those who contributed into the program. But this comes at the expense of those who contributed but receive nothing or those and/or their spouse who do not recover all the contributions plus accrued interest. The Social Security system has been modified to make it a better system, but it also created more bad unintended consequences. The following describes the intended and unintended consequences. What you must remember is that Social Security is really not a saving program. The money paid in by a contributor goes out of the system as current payments. This is especially true since the IOUs from previous contributors are now being cashed in. The main problem is that the IOUs will all eventually be cashed in. At that time the social security system will only be able to pay out each month that which is collected each month from current contributors. Either Government will have to start adding money from the General Fund (current tax revenue or from borrowing) to the Social Security Trust to continue sustaining the payment schedules or the benefits to recipients will have to be reduced. Even though Social Security is a government retirement insurance program, it is usually thought of as savings. The following analysis treats it as an equivalent saving program to illustrate the Good, the Bad and the Ponzi. The Good Social Security promises to make monthly payments to an individual beginning at a certain age, (62, 65, 66, 67 or 70) and lasting until their death. With a surviving spouse, the payment can continue till the spousesí death. An individual could collect payments from age 62 into their nineties or for some over 100 years of age. In an extreme case, an individual could pay FICA taxes for 40 years and that worker could collect payments for 40 years. Social Security and Medicare are both programs that are more generous by paying out more than the beneficiaries contributed to the programs. Fifty-eight (58) million retirees, spouses, children and disabled workers get monthly benefits from Social Security. About 161 million people contribute to Social Security every month. The average monthly payment is about $1,175. The range of payments is from less than $800 to more than $3,500. The amount is based on a percentage of the contributorís average lifetime income. The lower income contributors receive a higher percentage than the higher income contributors. But even with this equalizing the higher income contributor receives higher benefits. If a non-working spouse raised a family, with children, then this spouse can receive Social Security payments too. Upon the death of the primary breadwinner, the surviving spouse can select the highest of the payments of either the dying contributor or the surviving spouse. If the working contributor dies before reaching Social Security age, the surviving spouse and children can receive monthly payments until the children reach a certain age or finish college. The amount of the payment is based on the amount contributed over the years and calculated based on the most given over several recent years. The more you contribute the more you receive. Actually, payment should equal about 40% of average lifetime earnings. To receive benefits, you must have worked and contributed 40 quarters (10 years). The Bad High on the list of bad things that happen is that if a single with no children contributor dies before reaching retirement age, he/she receives no benefits, no payments from Social Security. And none of the benefits can be transferred to his/her heirs as in parents, brothers or sisters. All of the contributorís FICA taxes are gone: given to others. Itís a gamble that the contributor loses by dying. A gamble in which he/she had no choice: a forced taking of the output of his/her labor. If he/she worked to age 60 and died, nothing goes to heirs. That is 6.2% of his/her lifetime earning plus an equivalent 6.2% provided by his employer on his/her behalf is lost to his heirs. Whereas any savings, investments or home is transferred to others based on his/her will. Even if a spouse is able to draw on the earnerís contributions after death, the spouse may not reach the breakeven point for distribution. Again excess contributions to FICA are lost to the contributorís family. A one-time death benefit of only $255 is paid. Insurance benefits are generally non-taxable. But 85% of Social Security benefits are taxed for joint returns where total income is over $32,000. Currently 40% of Social Security recipients are taxed. Sample Calculation This is $27.805 billion dollars in taxes taken from Social Security recipients each year and transferred to the General Fund. Why isnít this money returned to the Social Security Trust fund to help extend the life of Social Security and provide for the future? I can only call this Redistribution from the older generationís savings to pay for Governmentís current spending. To solve this problem, the IRS could issue IOUs to the Social Security Trust for this money. The generational wealth transfer from the younger generation to the older generation is built into the entitlement programs of Social Security and Medicare. The younger generation pays for the older generationís benefits. The Ponzi In a Ponzi scheme, the investor is promised an unreasonable rate of return, usually much higher than anywhere in the market place. Since the investment cannot support this promise, the scheme manager must get more and more investors using their money to pay the return for previous investors. This cycle continues on and on, requiring more and more investors to meet promises to previous investors. If at any point, when new investors canít be found, the scheme falls apart. Social Security started out with 42 contributors (investors) for each single retired individual. Today this ratio is about 3 to 1 and soon to be 2 to 1, if it is not already there. Failure is imminent. The Ponzi kicks in when the payout to an individual is greater than the amount he contributed over their lifetime plus any accrued interest (call this the breakeven or equilibrium point). For those retired individuals who live past the period of time when they would receive all their payments back plus the interest accrued then, their gamble has paid off. Redistribution: The taking of money from one person to give to another person. At this point, when a social security recipient has passed the point of receiving more than they contributed, then the recipient become the recipient of redistribution: The Liberalís Progressive dream of taking money from one and giving to another. The problem with this redistribution is that it goes in all directions: from rich to working poor, from working rich to working middle class, from working poor to middle class, from working poor to working rich, from working middle class to working rich. Yes, it is right that redistribution of Social Security does not always come from higher earners and transfer to the lower earners. It often is redistributed to the higher earners from the contributions of the lower earners. In fact this may the norm and not the exception. The following represents the contributions and benefits for the year 2008. The blue line represents the payroll taxes paid and the red line represents the benefits paid per each income bracket.

The unique review of the above graph reveals several problems. The oblivious is that for the upper brackets the benefits are larger than the contributions. That is the lower brackets are supporting the upper brackets. But remember this is only a one year snapshot. You could assume that previous years contributions were excitedly higher for the upper income brackets. But I doubt it. On average the recipient takes 6 years to reach the point when they have received their contribution plus interest earned (breakeven point). The average of 6 years does not represent a good picture in that for some it may take up to 20 years to reach that point. But the results are the same for all those who outlive their breakeven point and they now enter the realm of the Ponzi scheme. The question becomes ďSince this is redistribution, why do some get more benefits (money) than others?Ē The answer is that it is neither an insurance program nor a savings program. But shouldnít everyone get the same benefits after the breakeven point? If itís a government program, then why doesnít everybody get the same benefits? Shouldnít the Government treat everybody equally? If it paid the same benefits to all, then we would all be equal. The Government can give away boatloads of money. But they should treat all citizens equally in this distribution of money. If the Government wants to give every retired person at age 65 $1,500 per month, it can. But if it does this, the Government also has to make tax revenues equal across all incomes too. How do we change the system? Congress could pass laws that could correct some of the flaws in the Social Security System.

Will this happen? No! Then how can we make it happen? Help us repeal the 16th Amendment, Income Tax, and change it to a consumption tax (example: FairTax) with no FICA taxes, leaving Social Security and Medicare/Medicaid as a Government spending program which treats each citizen the same. Help us. Consider contributing to our cause. Review our proposed Amendments and issues. |

Learn what you can do to help save our Nation! Visit our Website Home Page!

Print this Page - Printable Version

| DONATE TODAY! |

|